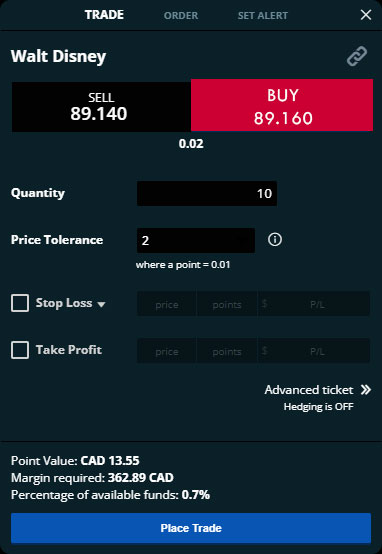

Close the trade when target is reached or to limit losses.

+6001160947406 or Request for a call back

Stop losses and take profits

Stop losses and take profits

As well as manually closing trades at their current price using market orders, you can use exit orders to set maximum levels of profit or loss.

- What are exit orders?

- What are take profits?

- What are stop losses?

- Types of stop loss

- Other order types

What are exit orders

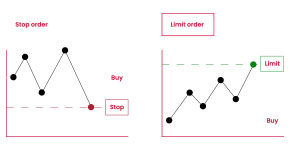

Exit orders are like entry orders. But instead of automatically opening a position, you use them to tell your broker or trading provider to close a trade when the market hits a specific level. Like with entry orders, you can use exit orders as either stops or limits.

You’ll often see limits referred to as ‘take-profit orders’ and stops as ‘stop-loss orders’. This describes what each does: you use limits to lock in a set amount of profit, while stops close a position if it incurs a certain level of loss.

What are take profits?

Take-profit orders are exit orders that you can set to automatically close a position if it reaches a specified price that is better than the underlying market’s current price. They can help you to be disciplined with your trading strategy and not chase profits unnecessarily.

Say, for example, you buy GBP/USD at 1.3260. You’re planning on closing your trade if it hits 1.3300, earning you 40 pips of profit. By setting a take profit at 1.3300, you’re leaving an order to automatically close the position there.

What are stop losses?

Stop losses are exit orders that you can set to automatically close a position if it reaches a specified price that is worse than the underlying market’s current price. Stop-loss orders are an essential tool to help minimize your losses if a price moves against you.

Let’s continue our above example. You’re aiming for 40 pips of profit from buying EUR/USD but are worried that the market may reverse. You only want to lose a maximum of 25 pips from your trade – so you set a stop loss at 1.3235 to automatically close it and limit your losses.

If you had shorted GBP/USD, then you would place your take profit 50 points below the current price at 1.3210, and your stop loss 25 points above it at 1.3285.

Types of stop loss

There are two types of stop losses: standard, and trailing.

Standard stops

Standard stops work in the way we’ve outlined above. You set a specific number of points from the current price of your trade, and if the market hits your specified level, the stop triggers and closes your position.

Trailing stops

Trailing stops follow your position, if it earns you profit, helping protect profits without limiting them.

Like standard stops, you set a trailing stop a specific number of points from the current price of your trade. But if the underlying market then moves in your direction, your trailing stop will move too, so it is still the same number of points below (or above, if you are short) the current price. If the market then moves against you, the stop will stay still.

If the market continues to reverse, your stop will trigger, closing your position and protecting any profits you’ve made until then.

Say you buy EUR/USD at 1.7045, with a trailing stop 30 pips away. If the pair moves up to 1.7080, then the trailing stop will move up to 1.0750.

If the market then reverses 30 pips, the trailing stop will stay put and trigger at 1.0750, locking in 5 pips of profit.

Other order types

Those are the most commonly used types of order. But there are a couple of others that can give you additional flexibility.

One cancels other (OCO)

One-cancels-other orders (OCOs) enable you to place two orders at the same time. If one of those orders is then triggered, the other will be automatically cancelled.

This is particularly useful when setting both a stop loss and a take profit on an open position. Should one of those orders trigger, the other will be cancelled so you can’t inadvertently open another trade. Most brokers – including FOREX.com – will automatically create stops and take profits as OCOs.

You can also use OCOs when opening a new position.

Say you think that EUR/USD is in for a significant market move but aren’t sure whether it will be up or down. You could create an entry stop order 10 pips above its current price and an entry limit 10 pips below. Then, if EUR/USD moves 10 pips in either direction, you’ll open a trade automatically – and the other order will be cancelled.

If-then orders

If-then orders are essentially two-step orders, where the second order is only created once the first has been triggered.

They’re mostly used to create an entry order that has an exit order already attached. That way, if your entry order is triggered, then a stop-loss or take-profit (or both) is automatically created too.

If-then orders allow you more flexibility and peace of mind. You don’t have to monitor the markets 24 hours a day to protect your position and can cover multiple outcomes to ensure the best result for your trade.