Close the trade when target is reached or to limit losses.

+6001160947406 or Request for a call back

Six steps to manage risk efficiently

Six steps to manage risk efficiently

Developing a trading risk management plan can seem like a daunting task. But by following these six tips, you can get started with a trading strategy that suits your trading style.

- Determine your risk tolerance

- Size each position correctly

- Determine your timing

- Avoid weekend gaps

- Watch the news

- Make it affordable

1. Determine your risk tolerance

Every trader has their own tolerance to risk.

Trading instructors will often recommend risking anywhere from 1% to 5% of the total value of your trading account on any given opportunity. But in truth, you should decide how much you want to risk based on what makes you comfortable.

Once you become more comfortable with the system you are using, you may feel the urge to increase your percentage, but be cautious not to go too high.

Remember, the goal of trading is to either realize a return or maintain enough to make the next trade.

If you’re trading once per day on average and risking 10% of your balance on each trade, it would only theoretically take ten straight losses to completely drain your trading account. On the other hand, if you were to risk 2% on each trade that you place, you would theoretically have to lose 50 consecutive trades to drain your trading account.

| Starting balance | % risked on each trade | $ risked on each trade | # of consecutive losses before $0 |

|

$10,000 |

10% |

$1000 |

10 |

|

$10,000 |

5% |

$500 |

20 |

|

$10,000 |

3% |

$300 |

33 |

|

$10,000 |

2% |

$200 |

50 |

|

$10,000 |

1% |

$100 |

100 |

2. Size each position correctly

Once you know how much to risk on any given trade, you should be able to plan the size of your positions.

Getting the right balance here is important. If you’re risking $100 on any given trade, then trading a standard lot of EUR/USD (100,000 units) probably isn’t a good idea. If the pair drops from 1.1300 to 1.1200, then you will already have hit your risk tolerance for the position.

One of the easiest ways to make sure you are getting as close to the amount of money that you want to risk on each trade is to customize your position sizes.

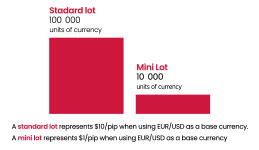

For example, a standard lot in a currency trade is 100,000 units. On EUR/USD, that represents $10 per pip. Meanwhile, a mini lot is 10,000 units.

In the realm of trading, having the flexibility to risk what you want, when you want, could be a determining factor to your success.

3. Determine your timing

Unless you’re planning on building or buying a sophisticated trading algorithm, you’ll need to be able to place trades yourself to take advantage of opportunities. Many markets are open 24 hours, which means deciding how much time you want to spend trading each day – and when you want to do it.

This also helps you get in the right mindset for trading, which can be useful for managing risk. Getting up at 3 a.m. to place a trade won’t necessarily mean you’re making the best decisions.

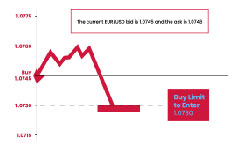

Exit orders are a useful tool for managing your risk when you aren’t fully focused on the markets. Some traders also use alerts to notify them when their positions are getting close to their maximum loss or profit target.

4. Avoid weekend gaps

Most popular markets close their doors on Friday afternoon (5:00 PM ET) in the US. Investors pack up their things for the weekend and charts around the world freeze as if prices remain at that level until the next time they’re able to be traded. However, that frozen position doesn’t show the full story. Markets are still moving throughout the weekend and may have moved drastically by the time you can trade them again.

As we covered in the Exit orders lesson, these gaps can move markets beyond your stop loss level. A good risk management plan should outline how you mitigate this risk. Come Friday afternoon, you’ll have the option to close your position.

While gaps aren’t necessarily common, they do occur, and can catch you off guard. As in the illustration below, the gaps can be extremely large and could jump right over a stop if it was placed somewhere within that gap. To avoid them, you could exit your trade before the weekend hits, and perhaps even look to exploit them by using a gap-trading technique.

5. Watch the news

News events can also exert significant impact on forex markets. Some – such as employment reports, inflation reports or central bank decisions – can create abnormally large moves. Some will even cause a sudden gap in a market that is fully open and trading.

Just as gaps over the weekend can jump over stops or targets, the same could happen in the few seconds after a major news event. So, unless you are specifically looking to take a strategic risk by placing a trade around to the news event, trading after those volatile events requires careful risk management.

6. Make it affordable

In trading, it’s often said that you should never invest more than you can afford to lose. The reason that is such a widespread manifesto is that it makes sense.

Trading can be risky and difficult, and putting your own livelihood at risk on the machinations of market dynamics that are varied and difficult to predict is rarely a good idea. So, don’t gamble away your hard-earned trading account: invest it in a way that is intelligent and consistent.

Watch the video below for a rundown of how to manage risk in your day-to-day trading.